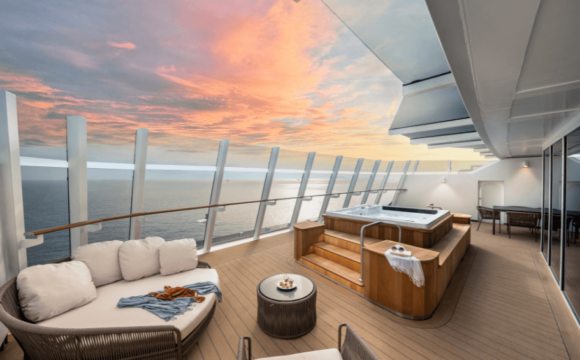

As the number of ocean cruises taken by UK and Irish passengers breaks the two million barrier for the first time, Allianz Assistance in the UK is advising sea faring holidaymakers to check their holiday insurance and make sure they are properly covered for any potential problems before their ship sets sail.

Unlike a ‘fly and flop’ holiday, cruising presents a different set of unforeseeable events; a missed port departure may incur unexpected accommodation costs while a cruise itinerary change because of bad weather may result in money lost through an unused pre-paid excursion or a missed flight.

“Both ocean and river cruising are becoming increasingly popular and it is an amazing way to see the world, but travellers do need to be aware of what is and isn’t covered in the usual multi-trip or ‘off-the-shelf’ travel insurance,” Kate Walker, Head of Direct for Allianz Assistance UK explains. “Getting the right policy in place is vital to ensuring you’re not going to be left high and dry in the event of unforeseen circumstances.”

As well as missed port departures and cruise itinerary changes, cruise travellers will need to consider what happens if they fall ill.

“While none of us want to fall ill on holiday or have an accident which affects us physically, unfortunately some of us do. Falling ill or needing to be hospitalised for other reasons, such as breaking an arm, bring about a new set of logistics if you need to be taken ashore for treatment,” points out Kate Walker. “Cruise interruption will not only pay for travel expenses incurred getting you to the hospital and covering medical expenses, if you’re able to, it will cover the costs of re-joining the cruise at its next port of call.”

Cruise travellers also need to be aware of what happens if they experience illness or injury and the on-board doctor confines you to your cabin. “Cabin confinement cover will pay you up to the limit of your policy.

“It will also provide this cover when the on-board doctor advises you not to leave your cabin due to a medical situation on board the ship.

“As well as checking the insurance policy details, our advice is to shop around; many insurance companies are now offering cruise cover as an add-on to their regular travel insurance policies and this may be a cost effective way of ensuring you’re covered at a level you’re comfortable with before setting sail,” concludes Kate Walker.