The hoarding of foreign currency is a hopeful picture for the travel and tourism industry says Sacha Zackirya, CEO – Change Group International PLC.

“The outbreak of Coronavirus has made people across the world stock up on ‘essentials’, from toilet roll to pasta, behaviours have changed along with life as we know it. Following the spread of the virus, at ChangeGroup International Plc, we closely monitored the demand for cash through our global network of ATMs and the data quickly highlighted that individuals were stockpiling emergency cash.

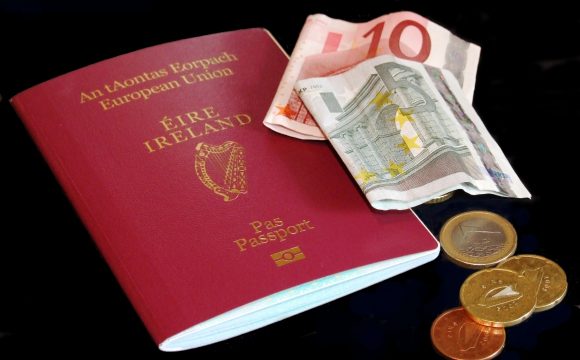

“The size of cash withdrawals from ATMs is now up by 23% with evidence suggesting that worried Brits will be hoarding cash in response to the economic impact of Coronavirus. The trend also extends past the UK, there has been a distinct increase from potential travellers in Europe, North America and Australia who are also hoarding dollars and euros, with many flights grounded and popular beach resorts closed for business.

“According to G4S, 50% of all consumer transactions worldwide are made in cash and this recent rush to extract cash highlights that in an emergency, many consumers believe in the safety of physical cash to purchase essential goods and services.

“You only need to look to the past twenty years to see that this trend is not a new phenomenon. While banking is more digital than ever before, there is an undeniable comfort from having complete control of finances in times of crisis. So, should we all be rushing to ATMs? Government and retailer advice has been to limit cash use. Contactless payments are being encouraged at major retailers, the contactless limit has even been increased from £30 to £45 to expand its use further. Perhaps retailers are relying too much on the frenzy of the ‘cashless society’ which differs across the UK. While many in urban hubs across the UK will rarely carry cash, it remains the payment of choice for many and a move to digital payment will be a difficult adjustment when trust in the economy is low.

“A wider return to cash may be good news for UK high streets as the retail industry faces one of its greatest threats. With tourism specifically, cash is a huge source of revenue for physical retailers. There are few ways to spend cash online and depositing cash back into the bank is an arduous process with bank branches closing nationwide and already varied waiting times for the cash to appear in your account. The hoarding of different currencies could prove to be a crucial lifeline for the travel and tourism industry as it may mean a quicker recovery once travel restrictions are removed. 10% of global GDP arises from travel and tourism, we live in a mobile world that has it’s brakes on. In a twelve-month period between July 2018 and July 2019, 64% of Brits took a foreign holiday, the number jumps to 88% when including domestic travel.

“Cashflow is under immense pressure for many businesses and the huge volume of physical cash may mean a quicker recovery for the tourism and retail industries. While we all stay home, those who provide services to the beloved travel and tourism are losing income at an unprecedented rate. While there is no guarantee of the impact, the hoarding of foreign currency is a hopeful picture for many who will expect Brits to travel again once the pandemic has passed.”