Exclusive new data from the UK’s top-rated budgeting app, HyperJar, hasfound that shockingly, 1-in-10 Brits admit to failing to budget sufficiently for their first holiday and fell into debt as a result. Concerningly, this comes at a time when general living costs continue to rise. However, this hasn’t deterred holidaymakers from planning getaways this summer – EasyJet has reported that planned flights are up 8% on pre-pandemic levels. In light of the the desire to escape abroad this summer, Mat Megens, personal finance expert and founder of HyperJar, offers his finance tips to help stop holidaymakers from falling into debt for the sake of a week in the sun.

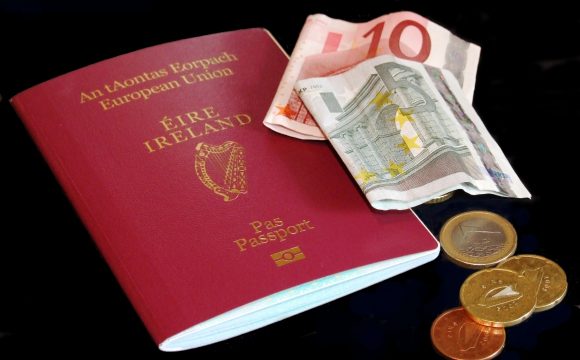

In a nod to Brits’ determination to continue going abroad despite tightening purse strings, new tracking research from AllClear Travel Insurance found that the number of people planning an overseas summer holiday has almost doubled since this time last year, with demand up from 34% to 64% in 12 months. However, at what cost? Concerningly outstanding credit card debt now sits at £63.9 billion, an increase of 9.01% in the year to February 2023, an indication that Brits may be turning to credit to fund a holiday.

To deter Brits from turning to credit to fund their summer holidays, HyperJar encourages people to save and budget for a getaway together – saving hundreds as a result. Highlighting that we are not always the most savings-savvy of our friends or family, data collected by HyperJar found that 22% of Brits have a friend whose money skills they envy and have learned from. Adding to this, 39% say they save and budget for holidays more effectively when doing so with a friend or partner, showing that clubbing together this summer could result in not only a better holiday, but also prevent people from overspending.

Personal finance expert and founder of HyperJar, Mat Megens stresses the importance of coming together for summer getaways amidst the cost of living crisis: “Despite the cost-of-living crisis showing no signs of slowing down, Brits are still clearly planning on going abroad with our research finding that over 1-in-3 Brits still plan to spend on holidays. At HyperJar, what we’ve seen is that more people are banding together through shared Jars to afford a holiday and I think that going into Summer, this will continue to be the case.

“Holidaying with other people means that you can get the best value abroad. If you’re single, go with a group of friends you’re happy to share accommodation with. To prevent any holiday dramas about who’s paid for what, agree a sum you’re all happy to pool together for things like meals out, cabs and trips, and use a HyperJar shared Jar to save up together before you go and spend from when you arrive.”